Profit centers may be more appropriate if the organization is decentralized, with separate business units operating independently. Cost centers may be better if the organization is centralized, with a single bookkeeping test measures knowledge of basic bookkeeping skills management team overseeing all operations. The management team focuses on minimizing expenses and increasing productivity, as their performance is evaluated based on how well they can manage costs.

Understanding Profit Centers

In this way, the measurement of both the elements, i.e. cost (input) and revenue (output) is in terms of money. A cost center is a collection of activities tracked by a company that do not generate any revenue. This center of activity is different from a profit center in which a profit center does generate both revenues and expenses.

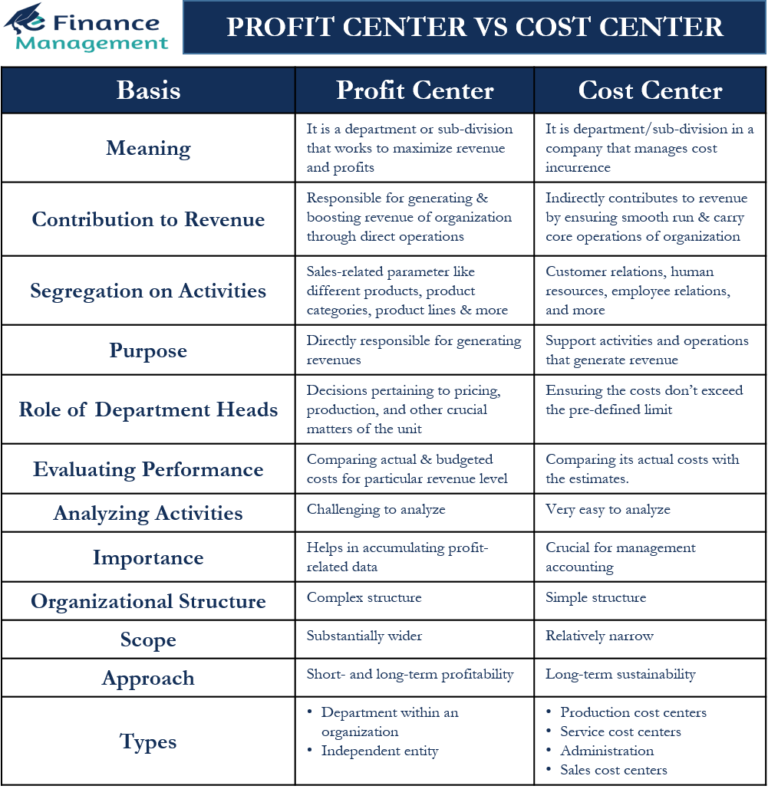

Difference Between Cost Centre and Profit Centre

While cost centers may indirectly contribute to revenue generation by supporting the activities of profit centers, their primary role is to provide support and services cost-effectively. Cost centers typically do not have the autonomy or authority to set prices or make strategic decisions that directly impact revenue generation. We’ve now covered the differences between cost centers and profit centers, but there’s a third type of division that you might come across. Investment centers are concerned not only with costs and revenues, but also with capital investment. For this reason, company divisions and subsidiary companies are sometimes called investment centers rather than profit centers.

The Accountability in Cost Centers vs. Profit Centers – Notable Differences

- A profit centre is a type of responsibility centre wherein the manager of the centre or unit is responsible for both cost and revenue for the asset assigned to the division.

- For this reason, cost-center accounting falls under managerial accounting instead of financial or tax accounting.

- A cost center may be more appropriate if the primary goal is to control and manage expenses.

- The accomplishment of a profit centre is estimated in terms of profit growth during a definite period.

- Their goal is to maximize revenue while managing costs to ensure sustainable profits and contribute to the company’s long-term success.

Amanda Bellucco-Chatham is an editor, writer, and fact-checker with years of experience researching personal finance topics. Specialties include general financial planning, career development, lending, retirement, tax preparation, and credit. It can include using automated systems, software, and other tools to reduce manual work and increase accuracy. Standard costs are being set as per the target to understand how well the mark is being fulfilled.

The Decision-Making Authority in Cost Centers vs. Profit Centers – Notable Differences

The goal of each division is to create the most value in terms of the difference between its revenues and costs. Profit Centre refers to that part of the firm for which collection of both cost and revenue takes place. These are responsible for generating profit be it through controlling cost or increasing revenue. The managers of profit centres focus on both the production and marketing of the product. It is the responsibility of the manager of the profit centre to generate revenue and incur costs in a manner to maximize profit. A cost center is a department or function within an organization that does not directly add to profit but still costs the organization money to operate.

The impact of cost and profit centers on the balance sheet and cash flow statement can also differ. Cost centers typically do not significantly impact the balance sheet, as they do not generate assets or liabilities. On the other hand, profit centers may create assets such as inventory and accounts receivable and liabilities such as accounts payable and debt. Rather, it can be said that without profit centers, cost centers would still be able to generate profit (though not so much); without the backing of cost centers, profit centers won’t exist. Management guru, Peter Drucker first coined the term “profit center” in 1945.

Cost centers only contribute to a company’s profitability indirectly, unlike a profit center, which contributes to profitability directly through its actions. Managers of cost centers, such as human resources and accounting departments are responsible for keeping their costs in line or below budget. In the business world, companies need to constantly analyze their financial performance and identify areas that can be improved to increase profitability.

Cost centers and profit centers are two fundamental concepts in business management that serve different purposes. While cost centers focus on cost control and efficiency, profit centers aim to generate revenue and maximize profitability. Understanding the attributes and differences between cost centers and profit centers is crucial for effective financial analysis, resource allocation, and decision-making within organizations. On the other hand, the primary objective of profit centers is to generate revenue and profits for the company. Profit centers are responsible for selling products or services to customers and generating revenue from those sales.