You can use our GST calculator to calculate the GST turnover of your business. To calculate the GST on the product, we will first calculate the amount of GST included, then multiply that figure by 10% (The GST rate). If you’re buying goods for resale through a business in Australia, it’s likely that the value of the imported goods will exceed A$1,000. The Goods and Services Tax (GST) is a broad-based tax of 10% on most goods, services, and other items sold or consumed in Australia. Introduced in July 2000 by the Howard government, the GST replaced several federal taxes, duties, and levies in a significant tax reform.

- Enter your desired amount in our GST Calc, Select GST ADD GST OR SUBTRACT GST and hit CALCULATE GST to see the results.

- The GST rate is applied to most goods and services sold in Australia, but there are still some exceptions.

- To calculate the cost including GST, multiply the price excluding GST by 1.1, and to find the GST amount divide the price including GST by 11.

- Once a business signs up for GST, it’s generally expected to stay registered for at least a year.

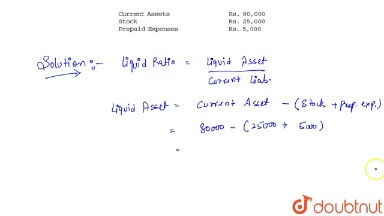

Use our Australian GST Calculator to quickly calculate how GST will apply to material variance your earnings. In Australia, the GST rate is 10%, so you would use this rate in your calculations. The table below specifies the relevent GST rates applicable in Australia, these were last updated in line with the published GST rates in 2024. Once you have identified the applicable GST amount, multiply it by the current GST rate.

There are two groups who can claim the GST back, first, the businesses that are registered for GST, second, Tourists using the Tourist Refund Scheme (TRS). The GST rate is applied to most goods and services sold in Australia, but there are still some exceptions. The information on this website is intended to be general in nature and has been prepared without considering your objectives, financial situation or needs.

Australian GST Calculator

Certain items are exempted from the Goods and Services Tax (GST), and these are referred to as GST-free sales or GST exemptions. If your organization is looking to register for Goods and Services Tax (GST), you’ll need to fill out an application form that can be obtained from the Australian Tax Office. It’s important to note that before your organization can register for GST, it must first have an Australian Business Number (ABN).

GST-free products and services list

Over 160 countries have adopted this kind of tax considering its popularity as an effective source of generating money. You can quickly work out GST on a product or service by dividing the price of the product by 11. To quickly calculate the amount of GST payable on imported goods, you can use our free, online GST calculator. You will only need to register for GST once, even if you operate more than one business, and can register online, over the phone, or through a registered agent when you first register your business.

Services

Australia GST Calculator will add your product/service to the Australia GST Table. Each time you add new information, the total amount will be updated so you can see the total costs of goods, products and services in Australia inclusive and exclusive or GST. Australia Reverse GST Calculator will add your product/service to the Australia GST Table. A GST calculator is a handy tool that helps businesses and individuals calculate the GST amount on different goods or services. It simplifies the process of calculating the net price of a product or service, including GST, or determining the original cost before GST was added.

Therefore, organizations should present their acquittals excluding the GST. If an organization is registered for GST, it is their responsibility to compute the GST portion that has been spent separately. In case there are any remaining funds, excluding the GST, these should be returned back how do i account for a line of credit to the respective department.

If they fail to register for GST when you are required to, you may be forced to repay the abel and carr formed a partnership and agreed to divide GST on any sales made from the date you were required to register, including penalties and interest. In Australia, sole traders, self employed individuals need to register for GST if they expect to aud 75,000 in one year. Sole traders who provide taxi or limousine services, need to register for GST regardless of their income level. The goods and services tax (GST) is a federal value-added tax of 10% on most services, sales, goods, and other items imported or consumed in Australia. The GST was first introduced on 1 July 2000 by the Howard Government, replacing the previous tax system.