We may earn a commission when you click on a link or make a purchase through the links on our site. All of our content is based on objective analysis, and the opinions are our own. As shown in the future value case, the general formula is useful for solving other variations as long as we know two of the three variables. This is because at 12% the $15,000 is actually worth $8,511.45 today, but you would need to make an outlay of only $8,000. According to these results, the amount of $8,000, which will be received after 5 years, has a present value of $4,540.

Formula For Present Value of a Single Amount

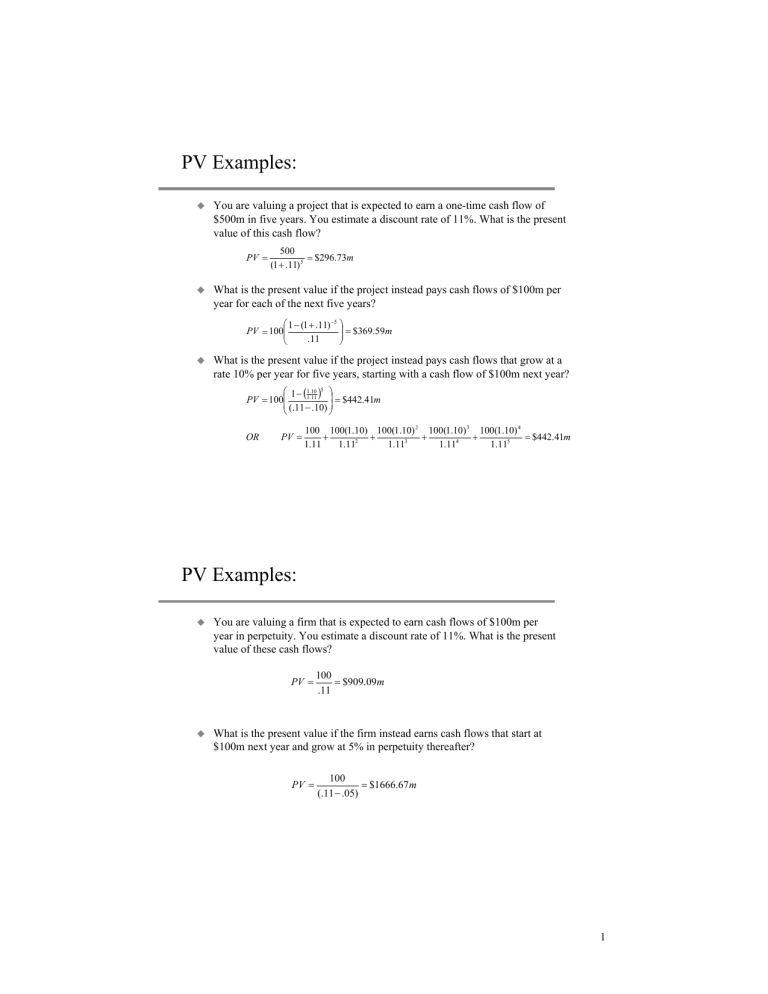

Let’s start with the simplest case, of estimating the Present Value of a single cash flow. We have a separate post on what capital budgeting is if you’re interested in learning more. But one of the most popular investment appraisal tools is the Net Present Value (NPV).

The One Decision That Can Make Or Break Your Financial Future

Many times in business and life, we want to determine the value today of receiving a specific single amount at some time in the future. Essentially, present value is an effective way of comparing investment decisions or purchase decisions. If you expect to have $50,000 in your bank account 10 years from now, with the interest rate at 5%, you can figure out the amount that would be invested today to achieve this. You expect to earn $10,000; $15,000; and $18,000 in 1, 2, and 3 years’ times respectively. Starting off, the cash flow in Year 1 is $1,000, and the growth rate assumptions are shown below, along with the forecasted amounts. Present value is also useful when you need to estimate how much to invest now in order to meet a certain future goal, for example, when buying a car or a home.

What Is The Net Present Value (NPV Calculator) of a Lump Sum Payment Discounted for Inflation?

The discount rate is actually a proxy for risk, and therefore, it’s how we penalise future cash flows for their level of risk. Conceptually, any future cash flow expected to be received on a later date must be discounted to the present using an appropriate rate that reflects the expected rate of return (and risk profile). This is a great example of the time value of money concept in action demonstrated through simple present value calculations. The present value of the annuity decreases the more time it takes to pay off if the future value and rate of return staying the same. In other words, to maintain the same present value the interest rate would need to increase parallel to the increasing number of years one is locked into an investment. In short, a greater discount rate is required to justify a longer term investment decision.

Present Value of an Annuity

- If you want to calculate the present value of a stream of payments instead of a one time, lump sum payment then try our present value of annuity calculator here.

- It is widely used in finance and stock valuation, although Net Present Value (NPV) is often preferred by experienced experts.

- Once these are filled, press “Calculate” to see the present value and the total interest accumulated over the period.

- We’ll assume a discount rate of 12.0%, a time frame of 2 years, and a compounding frequency of one.

- Since there are no intervening payments, 0 is used for the “PMT” argument.

Our online calculators, converters, randomizers, and content are provided “as is”, free of charge, and without any warranty or guarantee. Each tool is carefully developed and rigorously tested, and our content is well-sourced, but despite our best effort it is possible they contain errors. We are not to be held responsible for any resulting damages from proper or improper use of the service.

You should always consult a qualified professional when making important financial decisions and long-term agreements, such as long-term bank deposits. Use the information provided by the tool critically and at your own risk. This factor includes the given interest and periods and can now be multiplied by any amount of money to find the cooresponding present value.

Present value allows a solid basis where you can assess the level of fairness of any financial liabilities or benefits at a future date. So for example, a future cash rebate discounted to present value could or could outweigh the downsides of having a higher potential purchase price. The same calculation can be applied to 0% financing when someone buys a car from a dealership. For example, if your payment for the PV formula is made monthly, then you’ll need to convert your annual interest rate to monthly by dividing by 12. Also, for NPER, which is the number of periods, if you’re collecting an annuity payment monthly for four years, the NPER is 12 times 4, or 48. All future receipts of cash (and payments) are adjusted by a discount rate, with the post-reduction amount representing the present value (PV).

When the discount rate is annual (i.e. as with an interest rate on a certificate of deposit), and the period is a year, this is equivalent to the present value of annuity formula. This equation is used in our present value calculator as well, so you can use it for checking your PV calculations. The present value of an investment is the value today of a cash flow that comes in the future with a specific rate of return.

PV helps investors determine what future cash flows will be worth today, allowing them to understand the value of an investment and thereby choose between different possible investments. Present value can be calculated relatively quickly using Microsoft Excel. Present value is important real estate accounting course in order to price assets or investments today that will be sold in the future, or which have returns or cash flows that will be paid in the future. Because transactions take place in the present, those future cash flows or returns must be considered by using the value of today’s money.

The discount rate is highly subjective because it’s simply the rate of return you might expect to receive if you invested today’s dollars for a period of time, which can only be estimated. The term present value formula refers to the application of the time value of money that discounts the future cash flow to arrive at its present-day value. By using the present value formula, we can derive the value of money that can be used in the future. Assuming that the discount rate is 5.0% – the expected rate of return on comparable investments – the $10,000 in five years would be worth $7,835 today.