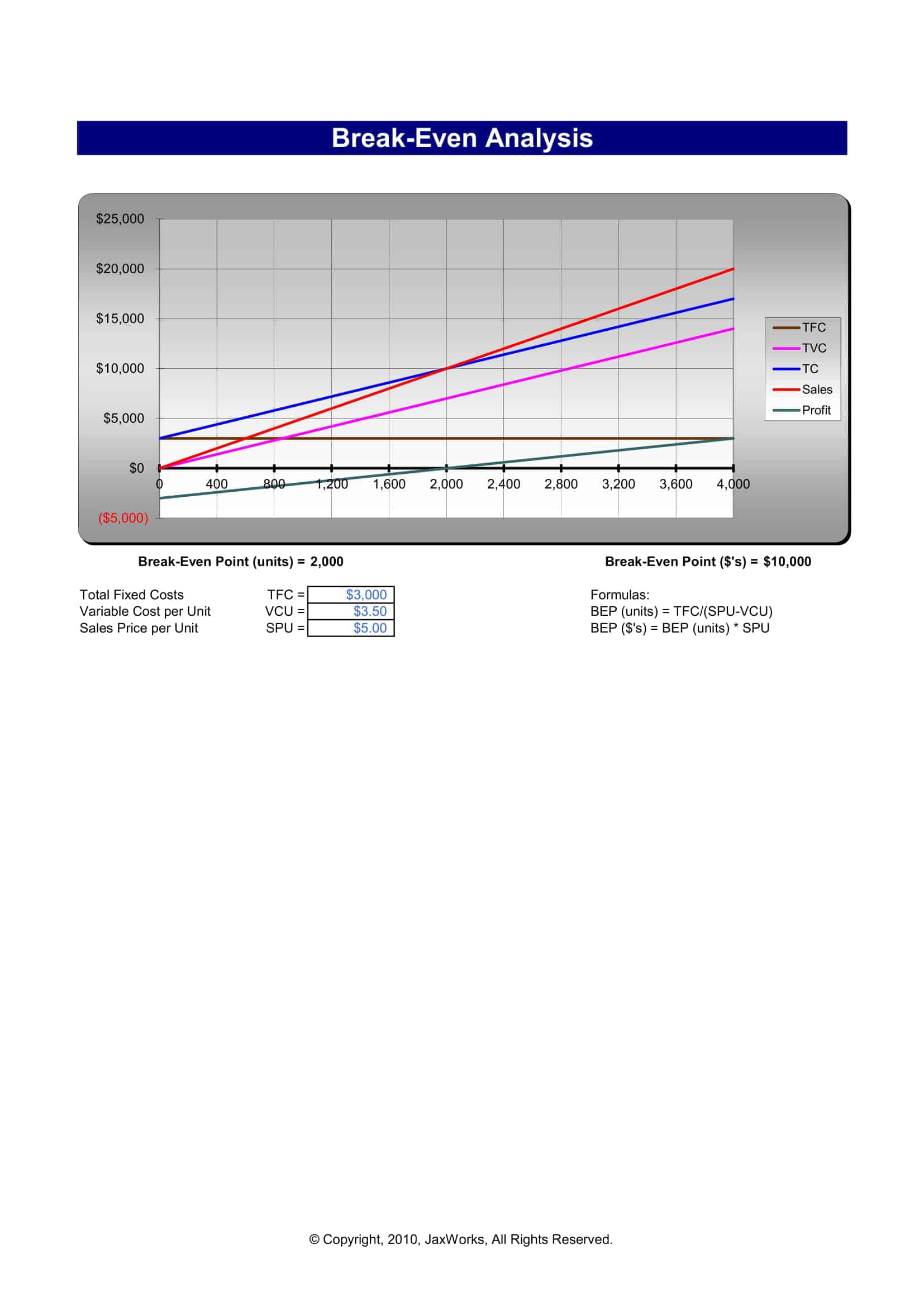

I have multiplied the break-even point by the expected sale ratio in this formula. ExcelDemy is a place where you can learn Excel, and get solutions to your Excel & Excel VBA-related problems, Data Analysis with Excel, etc. We provide tips, how to guide, provide online training, and also provide Excel solutions to your business problems. As you can see, the net operating income is zero, so you can say that the break-even analysis is correct. Our tutors are highly skilled in researching and writing quality content that is relevant to the paper instructions and presented professionally.

Target Audience

Businesses can maximise their profits if they are able to achieve a sales mix that is heavy with high-margin products, goods, or services. If a company focuses on a sales mix heavy with low-margin items, overall profitability will often suffer. This analysis is crucial for understanding the profitability of a product mix and helps businesses make informed decisions regarding pricing, production levels, and resource allocation. It takes into account the sales mix, contribution margin of each product, and the overall financial goals of the organization.

Strategic Cost Management

- The weighted average C/S ratio is useful in its own right, as it tells us what percentage each $ of sales revenue contributes towards fixed costs.

- The easiest way touse cost-volume-profit analysis for a multi-product company is touse dollars of sales as the volume measure.

- In computing for the multi-product break-even point, the weighted average unit contribution margin and weighted average contribution margin ratio are used.

- Costs that do not change with the level of production or sales, such as rent, salaries, and insurance.

The break even units are calculated as before except this time we use the weighted average contribution margin. The following dataset contains information on per-unit sales, per-unit variable expenses, and the expected sale ratio of 3 products, along with the company’s fixed expenses per month. The amount remaining from sales revenue after variable costs have been deducted, indicating how much revenue contributes to covering fixed costs.

Calculating break-even analysis in a multi-product environment

Fixed costs remain constant regardless of the volume of products sold (e.g., rent, salaries). In this formula, I have subtracted the total variable expense from the sales at the break-even point. Costs that do not change with the level of production or sales, such as rent, salaries, and insurance. Plan Projections is here to provide you with free online information to help you learn and understand business plan financial projections. It should be noted that as the business can’t sell a part of a product, the number of units is always rounded up.

Calculating the break-even on a company with only one product is relatively easy. Just take the total fixed expenses and divide by the contribution margin per unit. The contribution margin per unit is the unit sales price minus the unit variable cost.

Company

By following the step-by-step approach outlined in this essay, businesses can make informed decisions about pricing, production, and sales strategies to achieve profitability. The break-even point in units is equal to total fixed costs divided by the weighted average contribution margin per unit (WACMU). This assumption allows us to calculate a weighted average contribution per unit or batch and/or CS ratio which can be used to solve Break-even, margin of safety and target profit problems. The concept of a break-even chart is similar to a cost behavior chart, but with sales revenue shown as well. If the chart also indicates the budgeted volume of sales, the margin of safety can be shown as the difference between the budgeted volume and the break-even volume of sales.

Soul Sisters can use this CVP analysis for a wide range of business decisions and for planning purposes. Remember, however, that if the sales mix changes from its current ratio, then the break-even point will change. For planning purposes, Soul Sisters can change the sales mix, sales price, or variable cost of one or more of the products in the composite unit and perform a “what-if” analysis. It should be noted that this method of break even analysis for multiple products only works when the product sales mix remains constant. When preparing financial projections an estimate of the sales mix will be used and a break even position can be calculated. If as time passes the actual results reveal a different sales mix, then the financial projections would be revised and a new break even position must be determined using a revised sales mix calculation.

This information is used in computing weighted average selling price and weighted average variable expenses. In order to perform a break-even analysis for a company that sells multiple products or provides multiple services, it is important to understand the concept of a sales mix. Sales mix is important to business owners and managers because they seek to have a mix that maximises profit, since not all products have the same profit margin.

This makes us the best in the industry as our tutors can handle any type of paper despite its complexity. Unlike other companies, our money-back guarantee ensures the safety of our customers’ money. For whatever reason, the customer may request a refund; our support team assesses the ground on which the refund is requested and processes state income tax it instantly. However, our customers are lucky as they have the least chances to experience this as we are always prepared to serve you with the best. As a renowned provider of the best writing services, we have selected unique features which we offer to our customers as their guarantees that will make your user experience stress-free.